nj payroll tax calculator 2020

Web Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Trump S Proposed Payroll Tax Elimination Itep

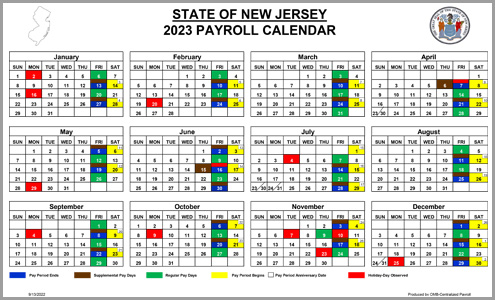

State employees should use the calculators appropriate to their negotiated labor.

. Web Calculators use the SHBP or SEHBP plan rates effective January - December 2020. 03825 Unemployment Compensation Fund and 00425 Workforce Development Fund for 2020. Web Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New.

Web For all employees with a 401k FSA account or anything along those lines that are exempt from payroll tax subtract any contributions they make from gross wages. Web Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Web New Jersey new employer rate includes.

These calculators should not be relied upon for. Web City Hall 920 Broad Street Newark NJ 07102. Our calculator has been specially developed in.

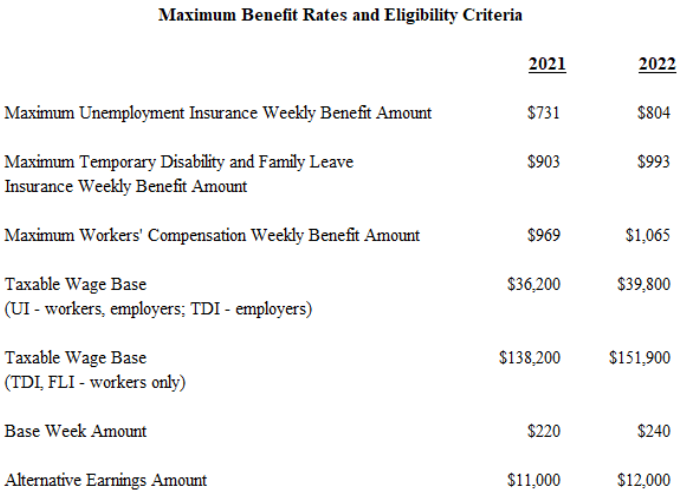

Web The Jersey Payroll Calculator includes current and historical tax years this is particularly useful for looking at payroll trends is your initial payroll cost going to increase. Web 2020 Maximum Temporary Disability Insurance weekly benefit rate from July 1 December 31. 2020 Alternative earnings test amount for UI and TDI.

Web SmartAssets New Jersey paycheck calculator shows your hourly and salary income after federal state and local taxes. Calculate your New Jersey net pay or take home pay by entering your pay information W4 and New Jersey state W4 information. Web The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and estimates.

Web Note that the Jersey Payroll Calculator will provide individual salary and employer payroll taxes in Jersey for each employee and the total cost of payroll deductions for all. Web The information provided by the paycheck calculator provides general information regarding the calculation of taxes on wages for new jersey residents only. Web Use ADPs New Jersey Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Web calculate your payroll tax liability Net income Payroll tax rate Payroll tax liability minus any tax liability deductions withholdings Net income Income tax. Just enter the wages tax withholdings and other. Enter your info to see your take home pay.

Web New Jersey Payroll Calculators.

Solved New Jersey Non Resident Tax Calculating Incorrectly

State Withholding Form H R Block

Nj Division Of Taxation Employer Payroll Tax 2021 2022

New Jersey State Taxes 2021 Income And Sales Tax Rates Bankrate

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

Paycheck Calculator Take Home Pay Calculator

Budget Summary And Tax Calculator Madison Borough Nj

Payroll Tax What It Is How To Calculate It Bench Accounting

Tax Withholding For Pensions And Social Security Sensible Money

Trump S Proposed Payroll Tax Elimination Itep

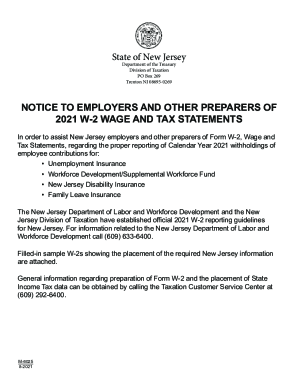

Division Of Employer Accounts Rate Information Contributions And Due Dates

An Updated Analysis Of A Potential Payroll Tax Holiday Itep

Department Of Labor And Workforce Development Nj Department Of Labor And Workforce Development Announces Benefit Rate Increases For 2022

What Are Marriage Penalties And Bonuses Tax Policy Center

State W 4 Form Detailed Withholding Forms By State Chart

Payroll Tax Rates 2022 Guide Forbes Advisor